In this article

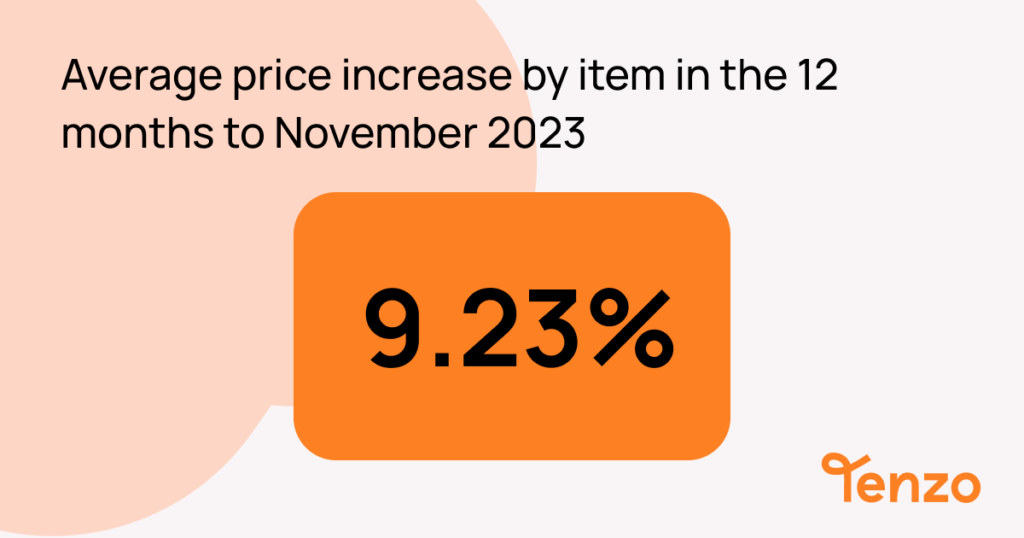

We took a deep dive into Tenzo data to see how prices of individual menu items have changed between November 2022 and today. By analysing a basket of over 60 items that have remained on menus over the last 12 months, we saw an average price increase of 9.23% per menu item.

Inflation in the food and drink space

It’s no secret that over the past year, inflation has been top of mind for restaurateurs. The cost of energy, food and drink rose at such an alarming pace that restaurants had no choice but to invest in revenue-driving actions – the most obvious of which is pricing.

But as the cost of living has risen for general consumers, restaurants have been concerned about increasing prices in line with inflation and spiralling costs for fear of pricing out regular customers. It doesn’t look like those fears have come to fruition though, as the number of transactions across the industry is not dropping.

So, as inflation falls, costs stabilise, and a hint of optimism in the forecasts, we thought we’d take a look at average menu item prices this November compared to November 2022 across a range of businesses and menu categories to see how restaurants have reacted to external pressures over the last 12 months.

How we put our basket together

Tenzo works with hundreds of locations across the globe so has a large amount of data on menu item prices. We pulled this research together by selecting 10 businesses of different sizes and types (bars, casual dining, quick service, fine dining, pubs) and choosing a random selection of dishes and drinks that were sold both in November 2022 and November 2023 and comparing the prices.

What we found was very interesting. There were no consistent increases e.g. where a business had put up prices by a fixed percentage. Every business has a different strategy.

In some examples, prices were raised the most on mains, but sides and drinks remained stable, whereas others only saw large increases in the price of add-ons such as drinks or desserts.

Some prices were increased by over 20%, but others actually decreased. It just goes to show that there are many routes to successfully increasing prices and that every business is unique.

By aggregating all this data, we saw that the average price increase was 9.23% across all businesses and items between November 2022 and November 2023.

How Tenzo’s research compares to other trackers

According to the ONS, the 12-month inflation rate in October 2023 in restaurants and hotels was 7.6%. However, food and non-alcoholic beverages saw the rate fall from 12.2% in September to 10.1% in October. In comparison, the Consumer Prices Index (CPI) only rose by 4.6% in the 12 months to October 2023.

As of publication, Truflation has the current rate of food and beverage inflation at about 8.3% in November, higher than the general rate of 3.89%.

The CGA Prestige Foodservice Price Index, which tracks the wholesale price of food for the industry, has dropped below 20% to 16.7%, the lowest since August 2022, but still far above the current rate of price increases.

What we believe we’re seeing is prices finally catching up with inflation and increased costs. When costs first spiked, businesses were unable to raise their prices at the same rate – the changes had to be more gradual.

What this means for the hospitality industry

With inflation finally slowing, businesses can now plan out their pricing strategies for 2024 rather than having to react to constantly rising costs.

We’re not completely out of the woods yet as the national minimum increases and UK wage inflation remains at 8%, but at least operators can plan for these and include them in their 2024 budgets.

With the most fruitful month of the year about to begin, let’s hope the strains on restaurant businesses are easing and that we’re entering a new era of success.