Goodbye 2024, hello 2025. It’s time to look back at the final quarter of last year to see how the hospitality industry fared.

As usual, we look at hundreds of sites in London and the South-East to see how restaurants, bars, pubs and cafes performed compared to last year.

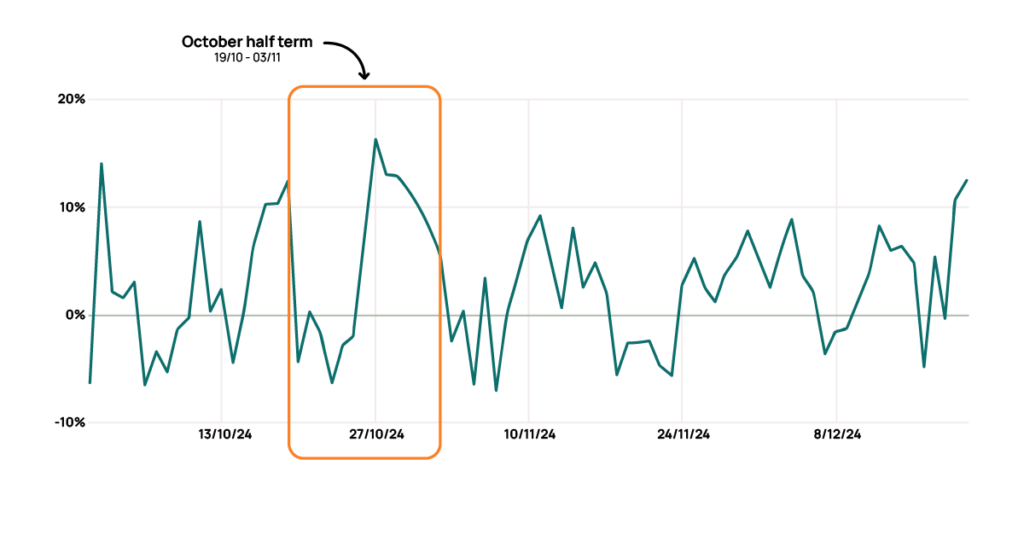

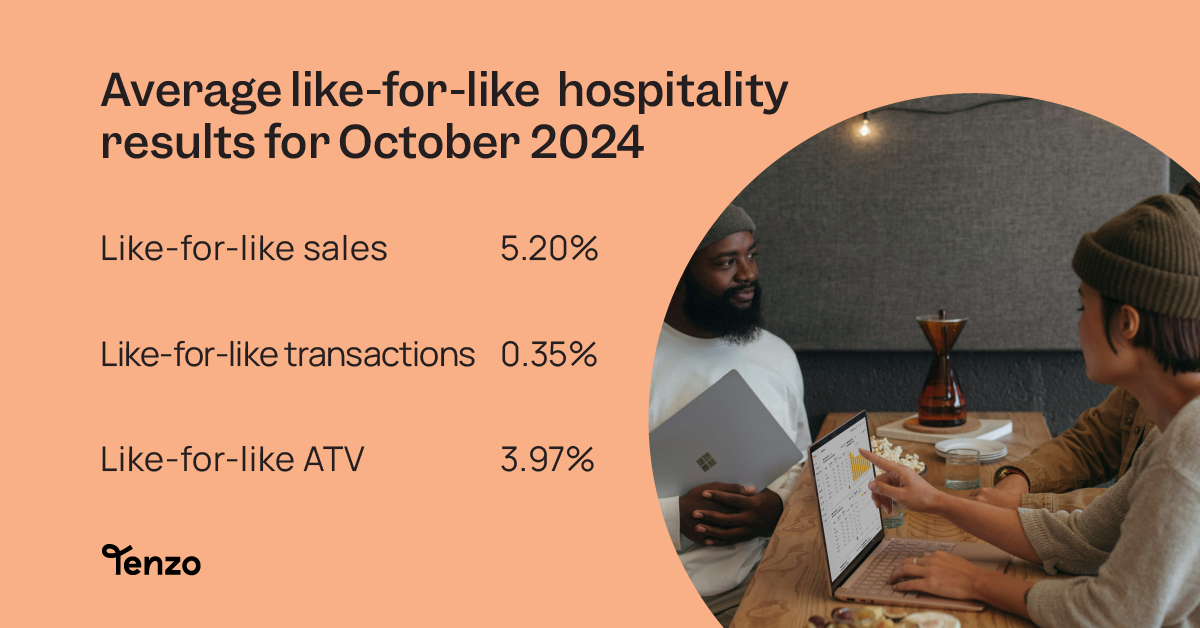

October and November’s hospitality results

Starting the quarter off strong, we saw increased like-for-like sales in both October and November (5.2% and 5.3% respectively). This was driven by increases in average transaction value rather than increased number of transactions, which prices rising about 4% year-over-year.

The good news is that both months outpaced CPI (2.3% for October and 2.6% for November) as well as the foodservice price index which was 2.2% in October.

December’s results

It’s no secret that December is a pivotal month for hospitality as it needs to make up for a traditionally weak January. While this year we did see like-for-like sales increase by 2.5% versus last year, it’s unlikely this will outpace December’s inflation.

Even in the immediate lead-up to Christmas, businesses were only showing slight increases with CGA by NIQ reporting restaurants seeing a 2.7% like-for-like increase in the week commencing 16/12/24 vs week commencing 18/12/23.

Christmas & New Year’s performance

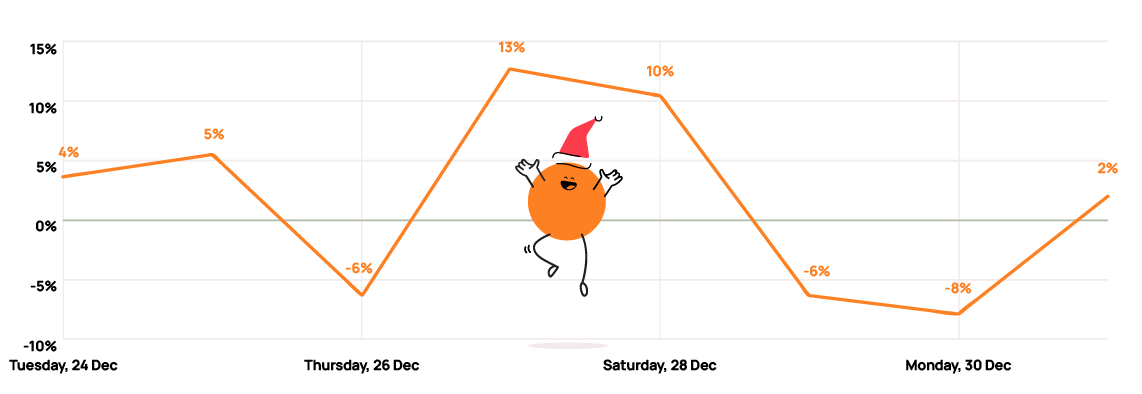

For businesses open over the Christmas period, the day itself was a success with a 5% increase over Christmas 2023. However, our data shows that only 10% of the sites we track are open on Christmas Day.

For the 67% of businesses open on Christmas Eve, sales were up 4% vs last Christmas eve. Boxing Day is where we saw the biggest drop of the festive season with sales 6% lower than they were last Boxing Day. The terrible weather might be to blame for that.

We tracked the days between Christmas and New Year date-to-date rather than our normal day-to-day. The graph below looks at the 28th this year vs the 28th last year despite the fact that it was a Saturday this year and a Thursday last year. Therefore, the increases on the 27th and 28th are to be expected as are the decreases on the 29th and 30th (this year’s Sunday and Monday, but last year’s Friday and Saturday).

New Year’s Eve thankfully did see a sales increase of 2% despite it falling on a Tuesday this year.

Looking forward to Q1 2025

So what can we expect for the coming quarter? Given the announcements in October’s Budget, businesses will need to put prices up to combat costs coming their way in April. In their letter to the Chancellor, UKHospitality shows how the increase in NI contribution and the lowered threshold are a real blow to hospitality businesses. This coupled with a further increase in National Living Wage means that businesses will have no choice but to increase their prices and cut costs.

Kate Nichols, CEO of UKHospitality stated, “There is a tsunami of cost and tax increases hitting businesses in the next quarter with no signal from the Government about how that is going to be offset.”

In good news, Valentine’s Day falls on a Friday this year: the first weekend Valentine’s Day since 2020, so businesses can expect a bumper weekend. And Mother’s Day is the final Sunday of the quarter, hopefully ending it on a high.

We’ll be back at the beginning of April to report on Q1, but in the meantime, follow us on Linkedin to get updates on monthly numbers and Valentine’s Day weekend!